unito

© unito.one 2025

unito

© unito.one 2025

Whitepaper

The fundamentals behind Unito’s decentralized lending protocol, including its architecture, tokenomics, risk model, and long-term vision.

View Whitepaper

Our Vision:True Decentralization

Our protocol is not just a platform; it's a Decentralized Autonomous Organization (DAO) governed by you, the token holders. Every critical decision is made through on-chain voting. Your tokens give you direct power to shape the future of the ecosystem.

Tokenomics: The Power of Your Token

Our governance token is the core of the ecosystem, designed for utility and control, not speculation. Its value is derived from its role in governing and securing the platform.

1.

Governance & Control. Token holders can propose and vote on all key protocol decisions. The weight of your vote is proportional to your token holdings. Key areas of governance include:

Asset listing: Adding new cryptocurrencies as collateral or lendable assets.

Risk parameters: Adjusting loan-to-value (LTV) ratios, liquidation thresholds, and interest rate models.

Treasury management: Directing the use of the Protocol Treasury for grants, development, and strategic initiatives.

Upgrades & features: Approving all new functionality and updates to the protocol.

2.

Staking & Protocol Security Holders

can stake their tokens, which acts as

the protocol's insurance mechanism.In the unlikely event of a shortfall or liquidity crisis, a portion of the staked tokens may be used to cover losses, protecting the entire ecosystem. In exchange for securing the platform, stakers earn consistent rewards.

3.

The token is deeply integrated into the protocol, providing tangible benefits to

its holders.

- Potential for reduced transaction fees.

- The ability to use the token itself as collateral for loans.

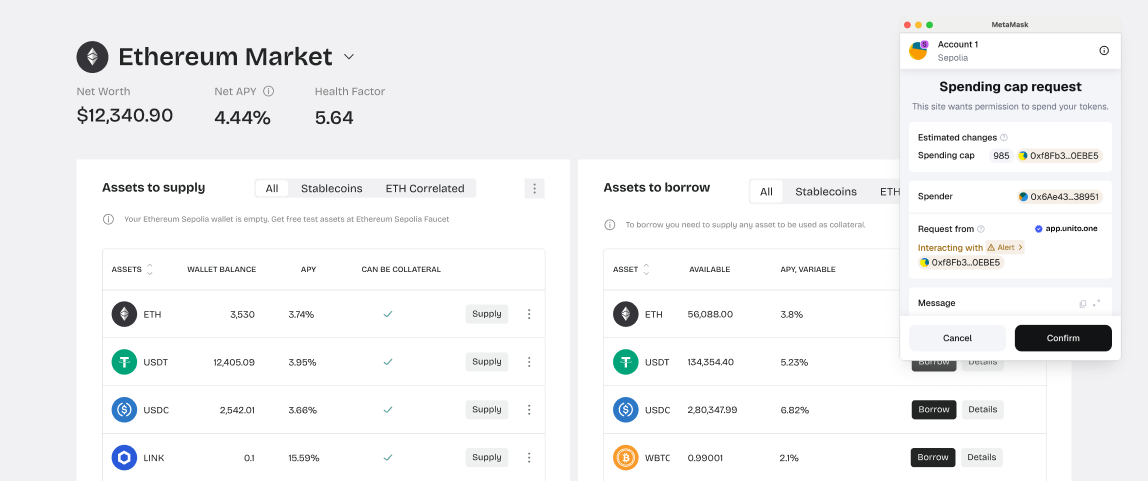

How It Works

1.

Users supply liquidity to pools (e.g., ETH, USDC, WBTC, etc.) and begin earning interest.

2.

Borrowers take loans against their crypto collateral, paying interest.

3.

The protocol generates fees from

the spread between interest rates and other activities.

4.

The generated revenue is directed to the Protocol Treasury, rewards pool, and other uses as decided by token holder governance.

Become an Early Investor

We are raising our pre-seed round to build the foundation of the protocol and are looking for foundational partners to join us.

Our goal: Raise an initial pool of $500,000. This first commitment is crucial for establishing the core infrastructure and operations.

Use of Funds

This initial investment will be strategically allocated to three key areas:

Infrastructure

Forging strategic alliances to bootstrap initial liquidity and drive early adoption.

Legal

Ensuring a robust legal framework and navigating the regulatory landscape.

Partnerships

Forging strategic alliances to bootstrap initial liquidity and drive early adoption.

Successfully closing this round will enable us to launch the protocol and prepare for our next funding stage, a Series A round of up to $10 million, aimed at aggressive scaling and market expansion.

What You Get

Governance Tokens at the earliest and most favorable price.

Direct influence over the protocol's future success.

Voting rights in all key decisions regarding the platform's development.

Your Security Is Guaranteed

We value your trust. If we do not reach

our $500,000 target by the deadline, all invested funds will be automatically and fully returned to investors. Your participation is risk-free.

Get Started

Presale

Introducing

Next-generation DeFi lending platform, engineered for security, efficiency, and decentralized governance. We are building on the proven strengths of market leaders to create a more robust and community-driven financial ecosystem.

Our mission is to provide a transparent, secure, and highly efficient venue for crypto lending and borrowing, where the community of token holders has complete control over the protocol's destiny.

Participate in the exclusive Unito.one presale on Pinksale.

Next Financial Layer

Non-Custodial

Launch of an Evolved DeFi Protocol

First Supply

Ownership

Utility First

Join Presale On Pinksale

Participate in the exclusive Unito.one presale on Pinksale.

Join Presale On Pinksale

Our Vision:True Decentralization

Our protocol is not just a platform; it's a Decentralized Autonomous Organization (DAO) governed by you, the token holders. Every critical decision is made through on-chain voting. Your tokens give you direct power to shape the future of the ecosystem.

unito

Launchof a New DeFi Protocol

2025 →

future

Introducing

Next-generation DeFi lending platform, engineered for security, efficiency, and decentralized governance. We are building on the proven strengths of market leaders to create a more robust and community-driven financial ecosystem.

Our mission is to provide a transparent, secure, and highly efficient venue for crypto lending and borrowing, where the community of token holders has complete control over the protocol's destiny.

Tokenomics:

The Power of Your Token

Our governance token is the core of the ecosystem, designed for utility and control, not speculation. Its value is derived from its role in governing and securing the platform.

1.

Governance & Control. Token holders can propose and vote on all key protocol decisions.The weight of your vote is proportional to your token holdings. Key areas of governance include:

Asset listing: Adding new cryptocurrencies as collateral or lendable assets.

Risk parameters: Adjusting loan-to-value (LTV) ratios, liquidation thresholds, and interest rate models.

Treasury management: Directing the use of the Protocol Treasury for grants, development, and strategic initiatives.

Upgrades & features: Approving all new functionality and updates to the protocol.

2.

Staking & Protocol Security Holders can stake their tokens, which acts as the protocol's insurance mechanism. In the unlikely event of a shortfall or liquidity crisis, a portion of the staked tokens may be used to cover losses, protecting the entire ecosystem. In exchange for securing the platform, stakers earn consistent rewards.

3.

The token is deeply integrated into the protocol, providing tangible benefits to its holders.

- Potential for reduced transaction fees.

- The ability to use the token itself as collateral for loans.

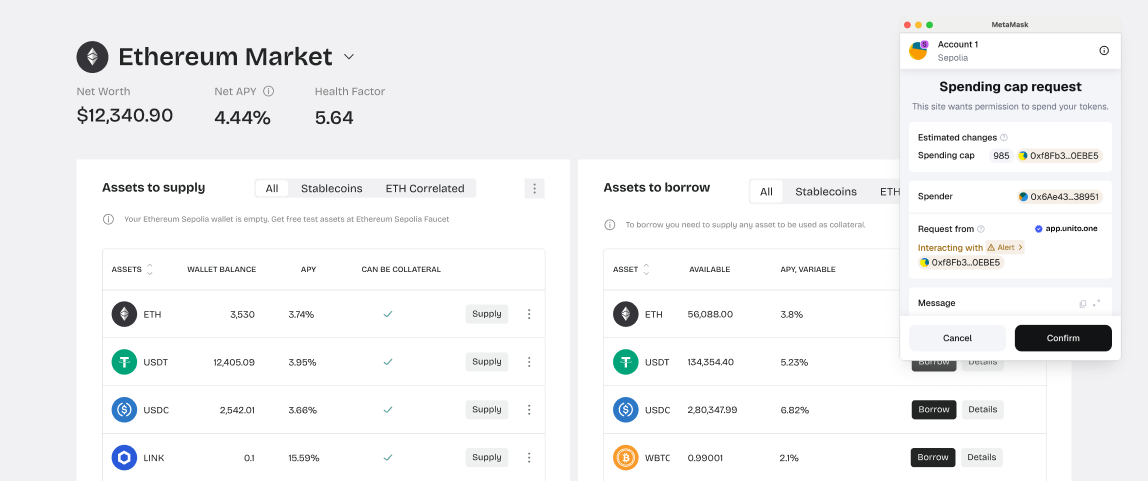

How It Works

1.

Users supply liquidity to pools (e.g., ETH, USDC, WBTC, etc.) and begin earning interest.

2.

Borrowers take loans against their crypto collateral, paying interest.

3.

The protocol generates fees from the spread between interest rates and other activities.

4.

The generated revenue is directed to the Protocol Treasury, rewards pool, and other uses as decided by token holder governance.

Become an Early Investor

We are raising our pre-seed round to build the foundation of the protocol and are looking for foundational partners to join us.

Our goal: Raise an initial pool of $500,000. This first commitment is crucial for establishing the core infrastructure and operations.

Use of Funds

This initial investment will be strategically allocated to three key areas:

Infrastructure

Forging strategic alliances to bootstrap initial liquidity and drive early adoption.

Legal

Ensuring a robust legal framework and navigating the regulatory landscape.

Partnerships

Forging strategic alliances to bootstrap initial liquidity and drive early adoption.

Successfully closing this round will enable us to launch the protocol and prepare for our next funding stage, a Series A round of up to $10 million, aimed at aggressive scaling and market expansion.

What You Get

Governance Tokens at the earliest and most favorable price.

Direct influence over the protocol's future success.

Voting rights in all key decisions regarding the platform's development.

Your Security is Guaranteed

We value your trust. If we do not reach our $500,000 target by the deadline, all invested funds will be automatically and fully returned

to investors. Your participation is risk-free.

unito

© unito.one 2025

Participate

in the exclusive Unito.one presale on Pinksale.

Next Financial Layer

Non-Custodial

Launch of an Evolved DeFi Protocol

First Supply

Ownership

Utility First

Join Presale On Pinksale

Participate in the exclusive Unito.one presale on Pinksale.

Join Presale On Pinksale

Next-generation DeFi lending platform, engineered for security, efficiency, and decentralized governance. We are building on the proven strengths of market leaders to create a more robust and community-driven financial ecosystem.

2025 →

future

Introducing

Our mission is to provide a transparent, secure, and highly efficient venue for crypto lending and borrowing, where the community of token holders has complete control over the protocol's destiny.

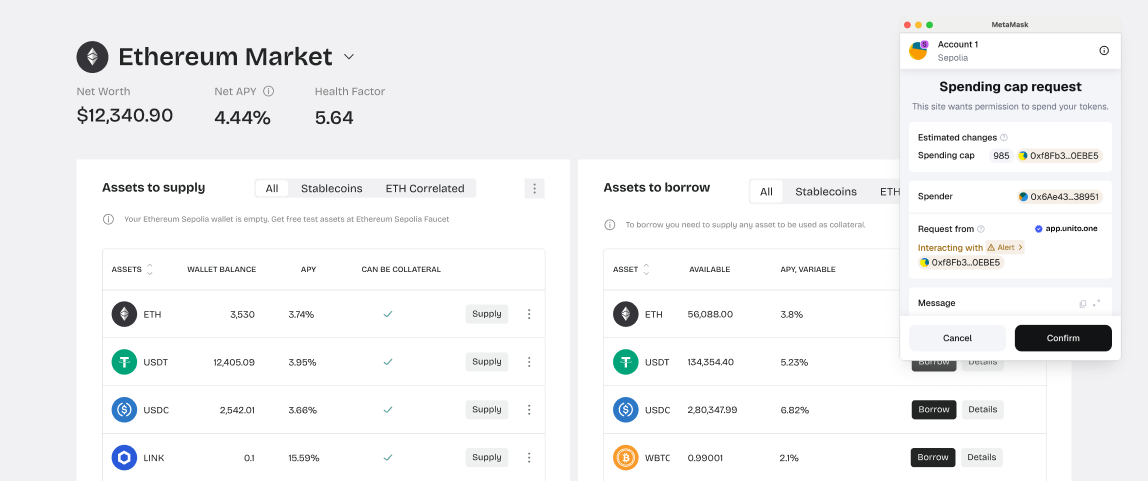

How It Works

1.

Users supply liquidity

to pools (e.g., ETH, USDC, WBTC, etc.) and begin earning interest.

2.

Borrowers take loans against their crypto collateral, paying interest.

3.

The protocol generates fees from the spread between interest rates and other activities.

4.

The generated revenue is directed to the Protocol Treasury, rewards pool, and other uses as decided by token holder governance.

Become an Early Investor

We are raising our pre-seed round to build

the foundation of the protocol and are looking for foundational partners to join us.

Our goal: Raise an initial pool of $500,000. This

first commitment is crucial for establishing the core infrastructure and operations.

Use of Funds

This initial investment will be strategically allocated to three key areas:

Infrastructure

Forging strategic alliances to bootstrap initial liquidity and drive early adoption.

Legal

Ensuring a robust legal framework and navigating the regulatory landscape.

Partnerships

Forging strategic alliances to bootstrap initial liquidity and drive early adoption.

Successfully closing this round will enable us to launch the protocol and prepare for our next funding stage, a Series A round of up to $10 million, aimed at aggressive scaling and market expansion.

What You Get

Governance Tokens at the earliest and most favorable price.

Direct influence over the protocol's future success.

Voting rights in all key decisions regarding the platform's development.

Your Security Is Guaranteed

We value your trust. If we do not reach our $500,000 target by the deadline, all invested funds will be automatically and fully returned to investors. Your participation is risk-free.

unito

© unito.one 2025

Our Vision:True Decentralization

Our protocol is not just a platform; it's a Decentralized Autonomous Organization (DAO) governed by you, the token holders. Every critical decision is made through

on-chain voting. Your tokens give you direct power to shape the future of the ecosystem.

Tokenomics:

The Power of Your Token

Our governance token is the core of the ecosystem, designed for utility and control, not speculation. Its value is derived from its role in governing and securing the platform.

1.

Governance & Control. Token holders can propose and vote on all key protocol decisions.The weight of your vote is proportional to your token holdings. Key areas of governance include:

Asset listing:

Adding new cryptocurrencies as collateral or lendable assets.

Risk parameters: Adjusting loan-to-value (LTV) ratios, liquidation thresholds, and interest rate models.

Treasury management: Directing the use of the Protocol Treasury for grants, development, and strategic initiatives.

Upgrades & features: Approving all new functionality and updates to the protocol.

2.

Staking & Protocol Security Holders can stake their tokens, which acts as the protocol's insurance mechanism. In the unlikely event of a shortfall or liquidity crisis, a portion of the staked tokens may be used to cover losses, protecting the entire ecosystem. In exchange for securing the platform, stakers

earn consistent rewards.

3.

The token is deeply integrated into the protocol, providing tangible benefits to its holders.

- Potential for reduced transaction fees.

- The ability to use the token itself as collateral for loans.

Get Started

Participate in the exclusive Unito.one presale on Pinksale.

Join Presale On Pinksale

Next Financial Layer

Non-Custodial

Launch of an Evolved DeFi Protocol

First Supply

Ownership

Utility First

unito

Launchof a New DeFi Protocol